Bond

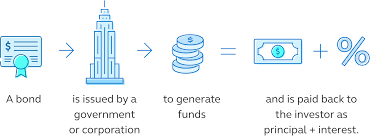

Bonds are financial products that resemble a loan from a lender to a borrower, usually a firm or the government. Because they offer the bondholder regular fixed interest payments, they are also referred to as fixed-income securities. We shall provide a straightforward explanation of bonds in this post, emphasising their characteristics, types, and differences from debentures. An organisation, like the government or a business, may issue bonds to investors when it needs to raise money. An investor who buys a bond becomes the issuer's creditor and is eligible to receive periodic interest payments, known as coupon payments, as well as the repayment of the bond's principal amount, also known as the face value or par value, when it matures.

Components of a Bond:

1. Face Value: The face value, often referred to as the par value, is the sum that the issuing company guarantees it will pay the bondholder when the bond matures. Usually, it is expressed in a certain currency, such dollars or euros.

2. Coupon Rate: The set interest rate that the bondholder will receive from the issuer on a yearly or semi-annual basis is known as the coupon rate. Its proportion of the bond's face value is how it is expressed. For instance, a bond with a $1,000 face value and a 5% coupon rate would yield $50 in annual coupon payments.

3. Maturity Date: The bond's face value must be repaid to the bondholder by the issuer on the maturity date. Bonds can mature over a variety of time frames, from a few months to many decades.

4. Yield: The return an investor can anticipate from a bond is represented by the yield. It considers the bond's coupon payments, its market purchase price (which may vary from the face value), and the amount of time before maturity. Depending on the unique features of the bond, yields can be stated as current yield, yield to maturity, or yield to call.

Types of bonds:

1. Government Bonds: National governments issue them to finance public spending. Due to the government's power to tax and generate money, they are typically regarded as low-risk assets. U.S. Treasury bonds, German Bunds, and Japanese Government Bonds (JGBs) are a few examples.

2. Corporate Bonds: Businesses issue these bonds to raise money for a variety of uses, including expansion, acquisitions, or debt refinancing. Compared to government bonds, corporate bonds have higher yields but also higher credit risk. When investing in corporate bonds, the creditworthiness of the issuing firm is crucial to take into account.

3. Municipal Bonds: Local governments or municipalities issue municipal bonds to finance infrastructure improvements or public services. Due to the fact that the interest generated on some municipalbonds is not subject to federal income tax, they are appealing to investors looking for tax-exempt income.

Bonds with no coupons are referred to as zero-coupon bonds. They are instead published at a discount from face value and expire at face value. By purchasing the bond at a lower cost and receiving the bond's full face value when it matures, the investor makes a profit.

Differences between bonds and debentures:

While bonds and debentures are both debt instruments, there are some differences between them:

1. Security: The issuer's unique assets, such as real estate or machinery, are sometimes used to underpin bonds, giving bondholders collateral. Debentures, on the other hand, are unsecured and aren't backed by any particular assets.

2. Priority of Payment: Bondholders have a greater priority for repayment than debenture holders in the event of bankruptcy or liquidation of the issuer. Principal and interest payments to bondholders are more likely to arrive before those to holders of debentures.

3. Interest Payments: Fixed interest payments at a predetermined coupon rate are often provided via bonds. On the other hand, debentures may have adjustable or floating interest rates that fluctuate according to the state of the market.

4. Issuer Type: Municipalities, companies, and governments typically issue bonds. Corporations usually issue debentures.

In conclusion, bonds are fixed-income securities that represent loans made by investors to governments or corporations. They offer regular coupon payments and repayment of the principal amount at maturity. They offer great ways to diversify the investment portfolio of the person.